Mastercard Economic Outlook 2023 Reveals Canadian Restaurant Spend on the Rise

As the global economy advanced at multi-speeds with uneven outcomes, many groceries, restaurants and food operators were left exposed and vulnerable to the impacts of inflation. However, some sectors of the industry thrived more than others, and as it turns out, there is a widespread new appreciation for restaurants in 2023.

According to the Mastercard Economic Outlook 2023, food prices remain high, but the price of groceries is outpacing that of food away from home, making restaurants a more economical option for many consumers. We’ve sifted through the data to pin down some numbers that reveal how the industry fared over the pandemic.

Restaurants Retain Appeal For Socializing

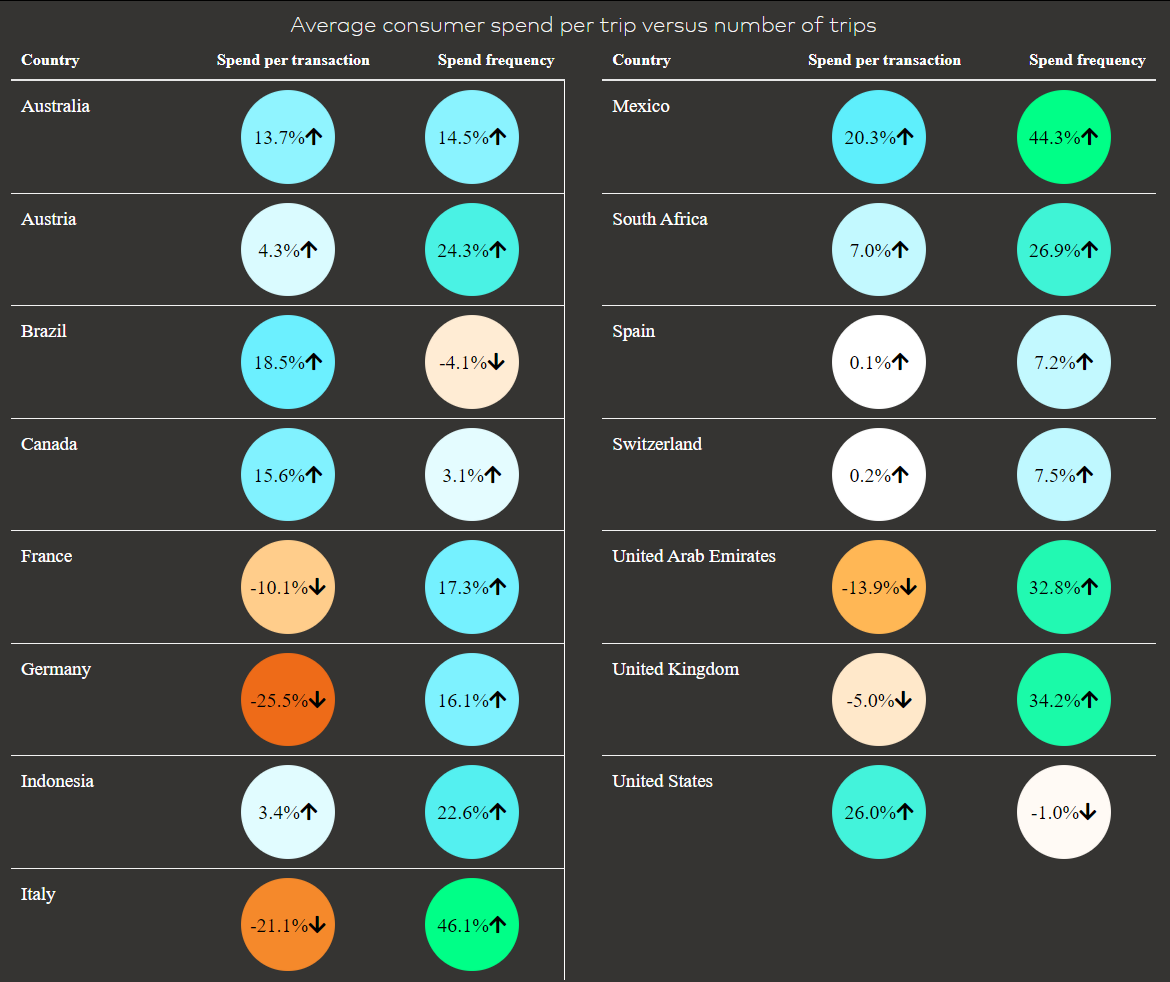

Consumers are going to restaurants more often for experience and social connection. However, they spend less per visit than they used to by choosing less expensive places or ordering less.

Mastercard expect this trend of consumers prioritizing experiences but remaining conscious of higher menu costs to accelerate in 2023 and become more widespread across the global economy.

However, in Canada, consumer spend frequency went up 3.1% while their spending increased by 15.6% more per transaction at restaurants.

Small & Medium Businesses Playing Catch-Up

Canadian wallets were not immune to this new and uncertain economic environment. The report indicates that Canadians are shopping small and ordering large. Mastercard observed that for small and medium-sized businesses in the restaurant industry, the in-restaurant spending at local businesses caught up with omnichannel spending (takeout, delivery and online services) at larger chains.

While large restaurants suffered the biggest losses during the pandemic, an omnichannel presence curbed losses for restaurants by 31 percentage points relative to their in-store-only competitors.

Simply put, presenting customers with multiple ways to spend can help to sustain you during economic downturns.

According to the report, an in-store and online presence has helped restaurants and groceries alike, connect with customers they otherwise would not be able to reach, broadening brand awareness, diversifying and expanding product offerings and sales, and maintaining more flexible and targeted pricing structures, meaning more economic (and shutdown) resilience, but this can vary significantly based on the store type.

Takeout to the rescue! - Consumers Continue Shopping For Food Online

While large restaurants suffered the biggest losses during the pandemic, an omnichannel presence curbed losses for small and large restaurants by 31 percentage points relative to their in-store-only competitors.

While global mobility is largely back to pre-pandemic levels and reliance on the online sales channel has dropped, we expect to see omnichannel restaurants continue to outperform as consumers keep shopping for food online at a higher rate than before the pandemic.

For Small-Medium Restaurants – During peak pandemic levels single channel (in-person) food operators with strictly in-person options plummeted from 35.1% consumer spend to – 45.9% while multichannel operations rode the storm out dropping from 35% to just over break even at 3%. Then, between August to October 2022, In-person customer spending soared up to 61.4%, while multi-channel operators returned to 64.9%

For Large Restaurants – During peak pandemic levels single channel (in-person) food operators with strictly in-person options plummeted from 29.4% consumer spend to –57.8% levels, while large multichannel operations remained steady, dropping from 28.9% to just 27.1%. Then, between August to October 2022, In-person customer spending skyrocketed back to 34%, while multi-channel operators trended upwards to 71.1%.

Eating Places - SMBs underperformed

Demand for eating out, especially for outdoor dining, has grown quickly since economies have reopened. For some restaurants, outdoor dining expanded their physical footprint, allowing them to serve more customers and generate more sales.

But many consumers are still eating at home-even if they’re ordering takeout. Small businesses have struggled to pivot to a takeout format, with packaging, labor costs and establishing the right online platforms serving as barriers.

All told, growth of SMB eateries is significantly underperforming large ones globally by roughly 17 percentage points in 2021 year-to-date, according to the Mastercard Small Business Performance Index, a marginal improvement from 2020.

Making Data-Driven Decisions to Drive Business

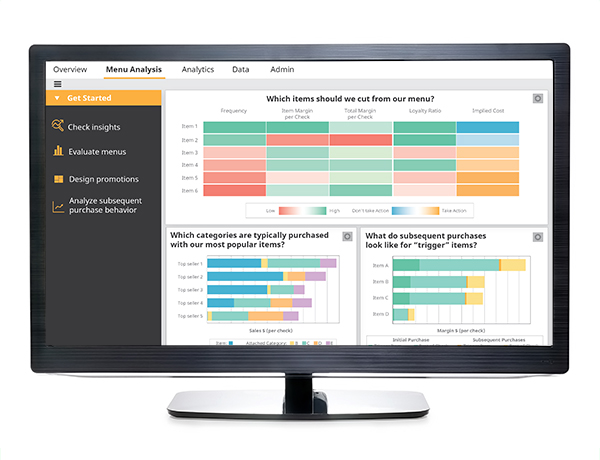

Mastercard Data & Services empowers restaurants to make data-driven decisions, navigate the shift to digital, acquire high-value consumers and engage existing ones. Menu Analyzer is a software platform that empowers restaurants to rapidly analyze these large datasets to inform promotional design, menu optimization, pricing, and marketing strategies.

Other tools on offer are Test & Learn®, which removes the guess-work by reading a loyalty program’s true impact, and Mastercard SpendingPulse that measures in-store and online retail sales across all forms of payment.